Forex Day Trading for Beginners: A Comprehensive Guide

If you’re looking to dive into the world of Forex day trading, you’ve come to the right place. This guide is packed with essential information to help you get started on your trading journey. In the fast-paced world of Forex trading, understanding the market dynamics and having the right strategies is crucial. Whether you’re trading in Uganda or anywhere else in the world, you can find reputable brokers that suit your needs. Check out the forex day trading for beginners Best Ugandan Brokers to start your trading adventure.

What is Forex Day Trading?

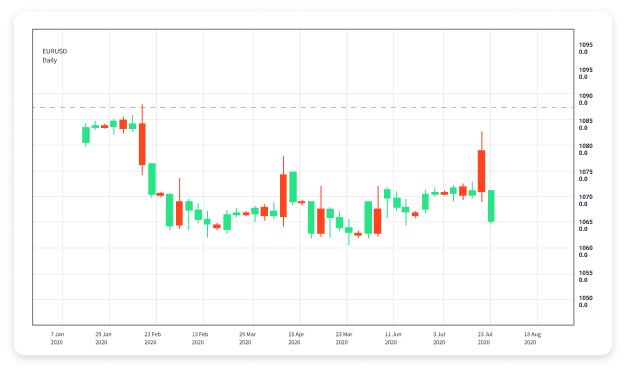

Forex day trading involves buying and selling currency pairs within a single trading day. The primary goal is to capitalize on short-term market movements and close all positions before the end of the trading day. Day traders typically utilize technical analysis, charting tools, and price patterns to make decisions about when to buy and sell currencies.

Understanding the Forex Market

The Forex market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. It operates 24 hours a day, five days a week, allowing traders to access the market at any time. This continuous operation facilitates day trading, enabling traders to react quickly to market changes.

Currency Pairs

In Forex trading, currencies are traded in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is the base currency, while the second is the quote currency. The price of a currency pair reflects how much of the quote currency is needed to purchase one unit of the base currency. Understanding currency pairs is crucial for any Forex trader, especially for beginners.

Key Terminology

Before plunging into day trading, familiarize yourself with some key terms:

- Pips: The smallest price move that a given exchange rate can make based on market convention.

- Spread: The difference between the bid price and the ask price of a currency pair.

- Leverage: The ability to control larger positions with a smaller amount of capital.

- Margin: The amount of capital required to open a leveraged position.

- Stop Loss: An order placed to sell a security when it reaches a certain price, limiting the trader’s loss.

- Take Profit: An order to close a position once it reaches a certain level of profit.

Getting Started with Forex Day Trading

To begin your Forex day trading journey, follow these essential steps:

1. Educate Yourself

Knowledge is your best weapon in the Forex market. Take the time to learn about trading strategies, indicators, and the factors that influence currency movements. Utilize online courses, webinars, and books to build a solid foundation.

2. Choose the Right Broker

Selecting a trustworthy and reputable Forex broker is crucial. Consider factors like regulatory compliance, trading platforms, customer support, and available trading instruments. As a beginner, it’s wise to opt for brokers that offer demo accounts, allowing you to practice trading without risking real money.

3. Develop a Trading Strategy

Having a well-defined trading strategy is essential for success in Forex day trading. Some popular strategies include:

- Scalping: Making multiple small trades throughout the day to capture minor price fluctuations.

- Trend Following: Identifying and following established market trends to maximize profits.

- Breakout Trading: Entering positions when the market breaks through key support or resistance levels.

4. Use Technical Analysis

Technical analysis involves studying historical price movements and using various indicators to forecast future price trends. Some commonly used indicators include:

Moving averages, Relative Strength Index (RSI), and Bollinger Bands. Incorporating technical analysis into your trading strategy can help you make informed decisions.

5. Practice with a Demo Account

Before trading with real money, practice on a demo account. This will help you gain experience and build confidence without the financial risk. Most brokers offer demo accounts that simulate real market conditions.

Risk Management

Effective risk management is vital in Forex day trading. Never risk more than you can afford to lose, and consider using stop-loss orders to minimize potential losses. A common rule of thumb is to risk no more than 1% of your trading capital on a single trade.

Tools and Resources

Utilizing the right tools and resources can enhance your trading experience. Some essential tools include:

- Charting Software: Helps analyze market trends and price movements.

- Economic Calendar: Keeps track of upcoming economic events that might impact the Forex market.

- Forex News Websites: Stay updated with the latest news and developments in the Forex market.

Common Mistakes to Avoid

Even with preparation, beginners often make mistakes in Forex day trading. Here are some common pitfalls to avoid:

- Failing to have a trading plan can lead to impulsive decisions.

- Overleveraging can result in significant losses.

- Disregarding risk management strategies can jeopardize your trading capital.

- Letting emotions dictate trading decisions.

Conclusion

Forex day trading can be an exciting and potentially profitable venture for beginners. However, it requires diligence, education, and a strategic approach. Remember to utilize demo accounts to practice, develop a solid trading strategy, and consistently educate yourself. By following the guidelines laid out in this comprehensive guide, you are well on your way to navigating the Forex market successfully. Good luck and happy trading!